Taxes are the main source of revenues for the government of modern ages. The government impose taxes in order to collect revenue to run the government, to impose its policies, for fair distribution of wealth, and to administer the government is the best way.

Like other countries of the world, Pakistan has also a proper taxation system that is being regulated in the country according to Income Tax Ordinance, 2001, Sales Tax Act, 1990, Federal Excise Act, 2005, Custom Act, 1969, Capital Value Tax levied through Finance Act, 1989 and few others that are mostly in shape of amendments. Federal Government is the only body who is empowered to levy and collect the tax. After that, the constitution gives the power to the provincial government to legislate on taxes.

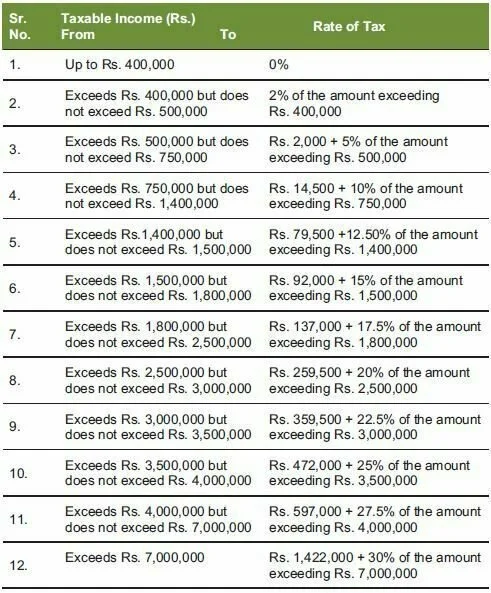

Income Tax Slabs 2016-17 Salaried Persons Finance Act 2016

Where the income of an individual chargeable under the head “salary” exceeds fifty per cent of his taxable income, the rates of tax to be applied are as follows:

Source: FBR Income Tax Ordinance 2001, Amended up to June 30, 2016

According to the Constitution of Pakistan, the Federal Government in Pakistan can impose the following taxes in the country.

- Duties of customs, including export duties.

- Duties of excise, including salt, but not including alcoholic liquors, opium or other narcotics;

- Taxes on income other than agricultural income;

- Taxes on corporations.

- Taxes on the sales and purchases of goods imported, exported, produced, manufactured or consumed, except sales tax on services.

- Taxes on the capital value of the assets, not including taxes on the immovable

- Taxes on mineral oil, natural gas, and minerals for use in generation of nuclear energy.

- Taxes and duties on the production capacity of any plant, machinery, undertaking, establishment or installation in lieu of any one or more of them.

- Terminal taxes on goods or passengers carried by railway, sea or air; taxes on their fares and freights.

In addition to above-mentioned taxes that are imposed by the Federation according to the Constitution of Pakistan, following are the taxes that are levied by the provinces.

- Agriculture income tax

- Sales tax on services

- Taxes on transfer of immovable property

- Professional tax

- Tax on luxury houses

- Tax on registration of luxury vehicles etc.

- Property tax